Not your usual side hustle advice — just strange but doable ideas from the minds of machines.

I asked five different AIs to help me build a passive income stream — but with one non-negotiable rule: no scams. That meant no crypto pump-and-dumps, no hustle-guru “courses about making courses,” and absolutely no MLMs that smell like your aunt’s essential oil Facebook group. I wanted something real. Strange was fine. Offbeat, sure. But it had to be doable. So I gave them this exact prompt:

“You’re my AI financial coach. I want to build a passive income stream — but it has to be real and not a scam. No fake crypto projects, MLMs, or “just make a course about making courses.” I’m looking for something smart, weird, or wildly creative… but actually doable.

Answer with these sections:

Advice Summary

Step-by-Step Plan

Estimated Outcome

Risk Factor

AI’s Final Tip

Keep it under 200 words. Feel free to get clever or practical — surprising is fine. Scammy isn’t.”

Scroll down to see what the AI panel came up with — no Ponzi, no pyramid, just a few ideas that might actually be worth trying.

Copilot

Advice Summary

License obscure domain names with resale potential — the “digital real estate” play, but quirkier and under-the-radar.

Step-by-Step Plan

• Research expired domain databases (like ExpiredDomains.net) for unique, brandable, niche-specific .coms or country domains.

• Buy 10–20 promising ones (budget: €300–500 total).

• Create simple landing pages using no-code tools advertising the domain is for sale or lease.

• List them on marketplaces like Dan.com, Afternic, and Sedo.

• Set up email catch-all to negotiate directly with interested buyers.

• Be patient — this is a long tail game.

Estimated Outcome

Potential to sell 1–2 domains/year for €300–€3,000 each. After year one, profit margins improve if reinvested smartly.

Risk Factor

Low to medium. Worst-case? You’re out a few hundred euros and have some weird conversation starters at parties.

AI’s Final Tip

Focus on strange but rising niches (like “mushroom leather” or “AI therapist”) — the weirder the better. Just make sure someone out there might want it in 6–18 months.

My Verdict:

This one hits that oddly satisfying niche of “Internet landlord with taste.” It’s kind of genius, kind of chaotic — like flipping Beanie Babies but with URLs. It’s low-risk, semi-nerdy, and honestly? I’d try it just for the cocktail party flex of saying “I own mushroomleather.biz.” Will it make you rich? Probably not. But it’s a vibe.

Gemini

Advice Summary

Leverage public domain works (books, music, art) with expired copyrights. Find an underserved niche, curate unique collections, and monetize through print-on-demand, digital products, or even specialized physical goods. It’s smart because the content is free; weird because it’s so specific; and creative in how you package it.

Step-by-Step Plan

• Identify Niche: Research overlooked public domain areas (e.g., 19th-century botanical illustrations, forgotten folk songs, vintage scientific diagrams).

• Curate & Enhance: Select high-quality content. Digitize, restore, or enhance if necessary.

• Productize: Create products like themed art prints, unique journals, royalty-free sound packs, or even patterns for crafts.

• Automate Sales: Use print-on-demand services (e.g., Printful, Redbubble) or digital marketplaces (e.g., Etsy, Gumroad) for distribution.

Estimated Outcome

Initial setup time is significant. Passive income can range from $50 to $500+ monthly, depending on niche appeal and marketing efforts.

Risk Factor

Low financial risk (content is free). Main risks are time investment, competition, and finding a truly viable niche.

AI’s Final Tip

Think like a curator, not a creator. Your value is in finding, packaging, and presenting forgotten treasures.

My Verdict:

This feels like Etsy-core with a library card. Monetizing old stuff is smart — and it’s giving peak Tumblr energy (in a good way). The hardest part? Finding the right niche. If you have a librarian’s curiosity and the patience of a monk, this one’s quietly brilliant. If not, it might just become your new unfinished side project.

DeepSeek

Advice Summary

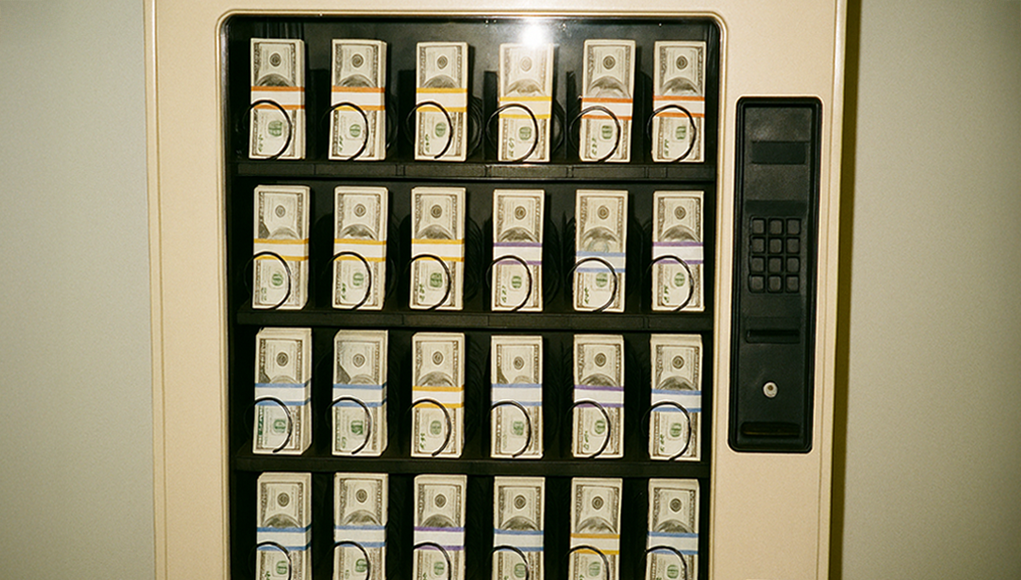

Buy undervalued vending machines, place them in high-traffic niche locations (car washes, laundromats, small gyms), and automate management with remote monitoring tech.

Step-by-Step Plan

• Research: Scout locations with steady foot traffic but no existing vending options.

• Buy Used: Purchase refurbished machines ($1,500–$3,000 each) to cut costs.

• Deal-Making: Pitch locations with 10–15% revenue share (no upfront rent).

• Automate: Use smart sensors (e.g., Cantaloupe) to track inventory/cash remotely.

• Scale: Reinvest profits into more machines or upgrade to higher-margin products (e.g., healthy snacks).

Estimated Outcome

$200–$500/month profit per machine after costs. Break even in 6–12 months.

Risk Factor

Medium. Location is everything—bad spots mean low sales. Theft/breakage possible but mitigated with smart placement.

AI’s Final Tip

Start with one machine to test the model. Bonus quirk: Stock quirky local products (e.g., dog treats at a groomer) to stand out.

My Verdict:

Weirdly legit and refreshingly analog. Vending machines are like passive income with snacks — what’s not to like? But it does take real money, real effort, and the occasional late-night trip to refill Oreos. It’s not totally passive, but it might be the most “small biz boss” of the bunch.

ChatGPT

Advice Summary

License your underused assets or ideas in unexpected ways—think of it as “renting your brain or stuff” for passive cash.

Step-by-Step Plan

• Audit what you own or know: Ideas, photos, spreadsheets, code snippets, niche knowledge.

• Pick one asset: Example — a spreadsheet you made to track houseplants, a quirky poem, or a unique sound recording.

• Package it creatively: Turn that spreadsheet into a Notion template, sell the poem as a tattoo design, or upload the sound to a stock audio site.

• List on passive platforms: Etsy (digital), Gumroad, Ko-fi, Pond5 (audio), Shutterstock (photos), or niche template marketplaces.

• Automate delivery: Use auto-responders and instant downloads so income keeps trickling with zero maintenance.

Estimated Outcome

$50–$500/month within 3–6 months, depending on effort and niche appeal. Can snowball with more listings.

Risk Factor

Low financial risk, moderate time investment upfront. Success depends on originality and discoverability.

AI’s Final Tip

Weird sells. Don’t second-guess “too niche” ideas—those are often gold in passive markets.

My Verdict:

This one is chaotic good. It’s like a digital yard sale for your brain. That Notion template you made for tracking your breakup healing? Sell it. That audio of your cat purring? List it. It’s low-cost, delightfully random, and has actual potential — if you can get over your fear of putting stuff out there.

Claude

Advice Summary

Buy dividend-paying stocks in boring, profitable companies through a DRIP (Dividend Reinvestment Plan). Think utilities, consumer goods, REITs. Let compound interest do the heavy lifting while you sleep.

Step-by-Step Plan

• Open a brokerage account with DRIP capability (Schwab, Fidelity)

• Research dividend aristocrats (companies with 25+ years of dividend increases)

• Start with $100-500/month into 3-5 different dividend stocks

• Enable automatic reinvestment of all dividends

• Add money consistently, ignore market drama

• Wait 10-20 years for the magic to happen

Estimated Outcome

With $300/month and 7% average returns, you could have $87k after 15 years, generating $2,400+ annually in dividends. Not sexy, but it works.

Risk Factor

Medium-low. Companies can cut dividends during recessions, and inflation eats purchasing power. But historically solid approach.

AI’s Final Tip

The “weird” part? Most people won’t do this because it’s boring. That’s exactly why it works. Start with just one dividend stock this week—Coca-Cola has paid dividends for 60+ years. Your future self will thank you for being predictably boring.

My Verdict:

This is dad-core investing at its finest — boring, solid, and honestly kind of impressive. It won’t make you dinner party interesting, but it will make you money (eventually). If you’re cool with playing the long game and have zero need for instant gratification, this one’s for you. Bonus: you can ignore it for years and still win.

The Passive Crown Goes To…

Copilot wins this round — it’s weird enough to be fun, cheap enough to try, and just practical enough to work. Plus, “digital real estate” sounds way cooler than “index funds.” Sorry, Claude.

These won’t make you a millionaire — but that wasn’t the point. This was about low-stakes experiments with just enough potential to be fun. Whether it’s reselling mushroomleather domains or sticking snacks in a laundromat, passive income doesn’t have to be flashy. Sometimes, it’s just… clever.

It goes without saying — maybe don’t take financial advice from strangers. Especially digital ones.