Once it was “Dear Sir, I am a Nigerian prince…” Now it’s cloned voices and deepfakes—today’s scammers are always a step ahead.

In the ever-evolving landscape of online fraud, artificial intelligence has emerged as both a marvel and a menace. While AI powers innovations that enhance our daily lives, it’s also being weaponized by scammers to create more convincing, scalable, and emotionally manipulative cons. From voice-cloned emergency calls to deepfake investment pitches, the digital con game has never been more sophisticated—or more dangerous.

AI Scams: The New Frontier of Fraud

Fraudsters are getting a tech upgrade, and nobody is safe. In 2024 alone, scammers stole a record $16.6 billion—a 33% jump from the previous year, according to the FBI. AI-driven scams played a massive role, exploiting technology’s ability to mimic human behavior and speech with alarming accuracy.

Voice Cloning Scams

Imagine receiving a frantic call from your child, claiming they’ve been in an accident and need money immediately. The voice is unmistakably theirs—but it’s not. Scammers are using AI to clone voices from social media videos, creating realistic audio clips that can deceive even the most discerning ears. These scams have led to significant financial losses and emotional trauma for victims.

Deepfake Video Scams

Deepfake technology has reached a point where it’s possible to create convincing videos of public figures saying things they never said. In one case, a deepfake video of Elon Musk was used to promote a fraudulent cryptocurrency scheme, leading victims to invest substantial sums based on the perceived endorsement.

AI-Powered Phishing Emails

Traditional phishing emails are often riddled with grammatical errors and obvious red flags. Not anymore. AI can generate polished, personalized emails that mimic legitimate correspondence from banks, employers, or government agencies, making it increasingly difficult for recipients to discern the fraud.

Romance Scams Enhanced by AI

Romance scams are not new, but AI has taken them to a new level. Scammers use AI-generated profiles and chatbots to engage victims in long-term relationships, eventually convincing them to send money for fabricated emergencies. The emotional manipulation is profound, and the financial losses can be devastating.

Protecting Yourself in the Age of AI Scams

Knowledge is your best defense—plus, a healthy dose of skepticism. Awareness is the first line of defense against these sophisticated scams. Here are some tips to safeguard yourself:

- Verify Identities: If you receive an urgent call or message, especially requesting money, verify the person’s identity through a separate channel.

- Be Skeptical of Unsolicited Communications: Unexpected emails or messages, even if they appear legitimate, should be treated with caution.

- Avoid Unusual Payment Methods: Be wary of requests for payment via gift cards, wire transfers, or cryptocurrency.

- Educate Yourself and Others: Stay informed about the latest scams and share information with friends and family.

- Use Strong Security Measures: Implement two-factor authentication and keep your software up to date to protect against unauthorized access.

As AI continues to evolve, so too will the tactics of scammers. Staying informed and vigilant is crucial in protecting yourself and your loved ones from falling victim to these increasingly sophisticated frauds.

Scams Before the Algorithms: 5 Old-School Online Swindles That Set the Stage for Today’s Frauds

1. Sweetheart Swindler: Rudy Kurniawan and the $30 Million Fake Wine Empire

Who: Rudy Kurniawan (Indonesia/USA)

When/Where: 2006–2012, USA

Kurniawan’s scam was pure vintage internet: He infiltrated the exclusive world of wine auctions, using online forums, email lists, and slick digital catalogs to peddle “rare” bottles. In reality, he was blending cheap wines in his kitchen, gluing on counterfeit labels, and selling them as centuries-old French treasures. Collectors, who prided themselves on their sophisticated palates, often never realized the difference—at least not until Kurniawan’s multimillion-dollar fraud unraveled in spectacular FBI fashion. His internet hustle exploited how even the most “exclusive” clubs get blinded by the promise of scarcity and status.

It turns out, a $10 bottle can masquerade as a $10,000 legend—if you’re brazen enough to sell it online to people who want to believe they’re sipping history.

2. Anna Sorokin, aka “Anna Delvey,” the Instagram Heiress Who Played Manhattan

Who: Anna Sorokin (Russia/Germany)

When/Where: 2016–2017, New York City

Sorokin, better known as Anna Delvey, spun an entire identity out of digital thin air. She crafted a glamorous Instagram persona, befriended the New York elite through DMs and influencer parties, and convinced everyone from hotels to personal friends that she was a German trust-fund kid. All she needed were a few temporary “loans” and the odd wire transfer delay. For months, she bounced from penthouse suites to downtown restaurants, using nothing but social media clout and PayPal screenshots as collateral. Her downfall? When hotels and friends finally realized the money she kept promising never actually existed. Her con was so slick, it went viral as a Netflix show, further blurring the line between scam and celebrity.

In the end, it took only a few forged emails and a killer Instagram feed to unlock a world usually reserved for the born-rich.

3. Craigslist Phantom Rentals: The Apartment That Didn’t Exist

Who: Various scammers (global, often anonymous)

When/Where: 2010s, worldwide

Here’s the pitch: You’re desperate for an apartment in an overpriced city. You spot the perfect listing on Craigslist—beautiful photos, amazing location, and a price that seems almost too good to be true. That’s because it is. The scammer, working behind a throwaway email and maybe even offering a “virtual tour” over FaceTime, asks you to wire a deposit to secure the place before someone else snatches it up. Once the money’s sent, the “landlord” vanishes and the apartment? It was never theirs to begin with. Often, the pictures are stolen from real listings or Airbnb, and the scammer plays on urgency—sometimes claiming to be out of the country, so you never meet them face-to-face.

Renters have even arrived at the door, suitcases in hand, only to find a confused real tenant or a locked, empty space—proof that FOMO and rent stress are catnip for online con artists.

4. eBay Motors “Phantom Car” Scheme: The Dream Car That Vanished

Who: Organized cybercrime rings, often Eastern Europe/USA

When/Where: 2000s–2010s, global

Buying a used car online is risky, but this scam took the gamble to a new level. Scammers would list eye-catching cars at can’t-miss prices, using stolen photos and VIN numbers for legitimacy. They’d promise free shipping, “eBay Buyer Protection,” or even send fake escrow site links to lull buyers into security. Once a deposit (sometimes the full price) was wired—often thousands of dollars—the listing vanished and the car never arrived. Many buyers didn’t realize they were duped until the real owner of the photo-lifted car was contacted, or until eBay confirmed the sale never existed in their records.

The scam’s success relied on trust in recognizable platforms and the promise of a “deal” just one wire transfer away—a classic case of online desire short-circuiting skepticism.

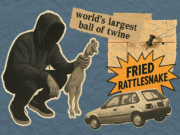

5. The “Nigerian Prince” Scam: The Email Royalty Who Finally Got Busted

Who: Michael Neu (Louisiana, USA—collaborating with Nigerian partners)

When/Where: 1990s–present, global

This is the email scam that practically wrote the rulebook for internet fraud. Victims around the world received messages claiming to be from a Nigerian prince or high-ranking official, urgently needing help to move millions out of the country. The catch? All you had to do was “temporarily” provide your banking details and wire a small fee to unlock your cut of the fortune. The scam’s baroque spelling and dramatic language became legendary, referenced everywhere from sitcoms to high school IT classes. The emails were intentionally over-the-top: scammers figured the truly gullible would self-select and follow through.

But while “Nigerian Prince” jokes are internet folklore, the operation had real teeth. In 2017, Michael Neu—a Louisiana man tied to the scam—was arrested for wire fraud and money laundering, finally putting a face to the world’s most notorious inbox criminal. Neu worked with partners in Nigeria, revealing how the scam evolved into a global enterprise. The FBI has estimated these “419” scams (named for Nigeria’s fraud statute) cost victims hundreds of millions per year, and versions still hit inboxes today.

The surreal part: the scam worked so well, for so long, that it’s outlasted AOL, dial-up, and most of the people who got hooked on it in the first place.